As investors continue to seek ways to predict changes in the stock market, they naturally pursue new and easier methods. The McClellan Oscillator is one such tool used to determine what direction the market is likely to take. The indicator is based on the accumulation/distribution line created by market analyst Sherman McClellan.

The McClellan Oscillator is a technical analysis indicator used to perform a kind of momentum analysis on a stock or index. The oscillator is calculated by subtracting the number of issues trading on high volume (accumulation) from the number of issues trading on low volume (distribution) and converging it to a single line, which tracks the difference.

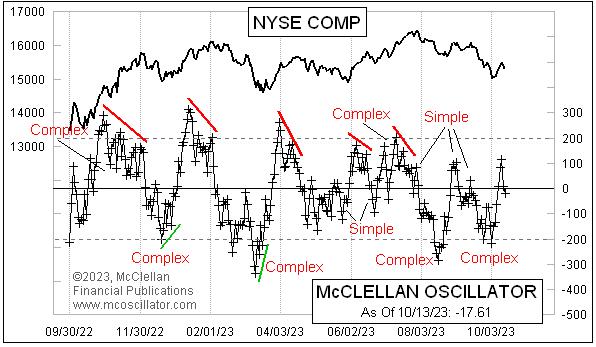

The McClellan Oscillator is often used as a leading indicator to signal when a reversal in the direction of the security or market could be about to occur. It works like this: When the oscillator is above zero, it is considered to be a positive signal for the market (markets are said to be in accumulation) while when it is below zero, it signals a bearish move could be coming (markets are said to be in distribution).

A great example of the McClellan Oscillator in action was seen when the indicator recently made a move above zero. By reaching a level above zero, it showed that the market had entered into an accumulation process and was likely to go up further. The market responded by making a big move higher the very next day, showing that the oscillator could be used as a short-term indicator of market direction.

At the same time, the McClellan Oscillator should be used with caution as it can be misleading especially when the market is in a strong uptrend or downtrend. While it may work as a short-term indicator of market direction, it should not be used as the sole method of analyzing market movements.

The McClellan Oscillator is an easy to use tool which can be used as part of an investor’s toolbox. It provides an indication of the direction the market is likely to take in the short-term and can help investors make more informed decisions. For example, if the oscillator is above zero, then it is likely that the market will rise further, and vice versa if the oscillator is below zero.