The cryptocurrency market has been seeing tremendous growth in recent years, with new use cases and products being developed continuously. One of the most interesting new developments in the space is the rise of Bitcoin futures. Recently, Bitcoin futures open interest has surged to all-time high levels, which is a good sign for the cryptocurrency market as a whole.

The concept of Bitcoin futures is relatively new. In its simplest form, a Bitcoin future is a contract that allows investors to speculate on the future price of Bitcoin. These futures allow investors to make bets on the future value of Bitcoin while avoiding the need for them to actually hold any Bitcoin. This makes it much easier for investors to hedge against swings in the bitcoin market, as well as taking advantage of potential gains in its price.

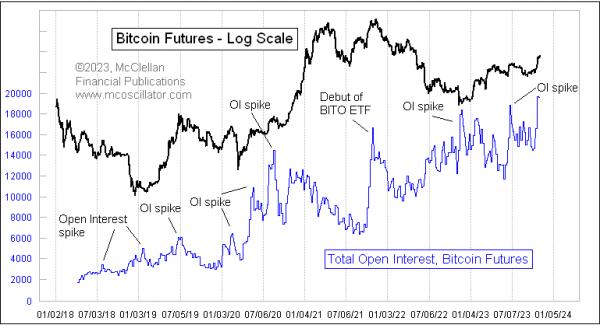

The rise of Bitcoin futures open interest has been phenomenal over the past few months. Open interest is the total amount of money invested in a particular futures market. When there is a surge in open interest, it is often a sign that the market is becoming increasingly popular and liquid. This can be a good sign for the overall market, as it suggests that more institutions and individuals are interested in taking part in this new financial product.

The surge in Bitcoin futures open interest is also reflective of the increasing institutional interest in the cryptocurrency market. The recent spike in open interest could be a sign of institutional investors entering the market, which is something that could further bolster the cryptocurrency market as a whole.

All in all, the surge in Bitcoin futures open interest is a great sign for the entire cryptocurrency market. It suggests that the market is becoming increasingly popular, which could be a catalyst for more investment. Additionally, it could signal that institutional investors are beginning to take an interest in the market, which could further bolster the market as a whole.