Investment grade bonds can provide a steady and reliable income stream for many investors, but there are risks associated with such bonds. One way to help identify potential risks and opportunities within the bond market is to use the McClellan Oscillator.

Understanding the McClellan Oscillator

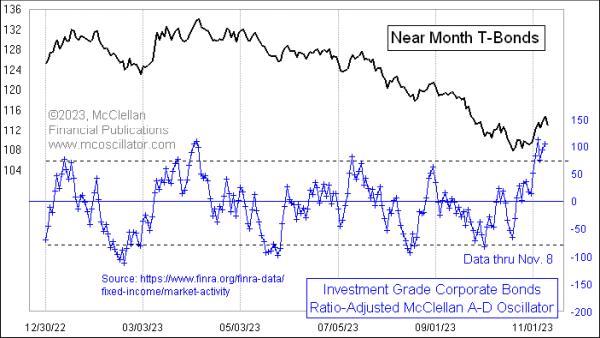

The McClellan Oscillator is an oscillator-based technical analysis tool intended to help investors identify and monitor the cyclical movements of stock and bond markets. Developed in 1969 by Sherman and Marian McClellan, the oscillator tracks buying and selling pressure in the market by calculating the difference between advancing and declining stock prices on a set timeline.

When the McClellan Oscillator shows a negative divergence from its moving average, it is an indication to investors that the trend of bonds is downward and that a short position should be taken. Conversely, when the McClellan Oscillator shows a positive divergence from its moving average, it is a signal that the trend of bonds is upward and that a long position should be taken. Investors may also use the McClellan Oscillator to identify potential buying opportunities when prices have become oversold.

Using McClellan Oscillator for Investment Grade Bonds

The McClellan Oscillator can be used to analyze and monitor trends of investment grade bonds. Investors may use the oscillator to determine whether the bond market is currently in a state of bullish or bearish sentiment. By tracking the advancement or decline of a bond, an investor can better evaluate the risk associated with the bond and make a more informed decision about whether or not to purchase.

In addition, the McClellan Oscillator can help investors identify and capitalize on potential investment opportunities within the bond market. For example, if the oscillator indicates a bullish sentiment in the bond market, investors may be able to purchase investment grade bonds at a lower price before prices increase. Similarly, if the oscillator identifies a bearish sentiment in the bond market, investors may be able to capitalize on potential short positions to lower their losses or increase their profits.

Conclusion

Overall, the McClellan Oscillator can be a useful tool for investors looking to analyze and monitor the volatility of investment grade bonds. By using the oscillator to stay informed of market conditions, investors can stay ahead of market trends and capitalize on potential investment opportunities.