The world of investing is fast moving, and having up-to-date information is incredibly valuable. Today’s article focuses on the Nasdaq 100 (QQQ), Communication Services (XLC), and Transportation (IYT).

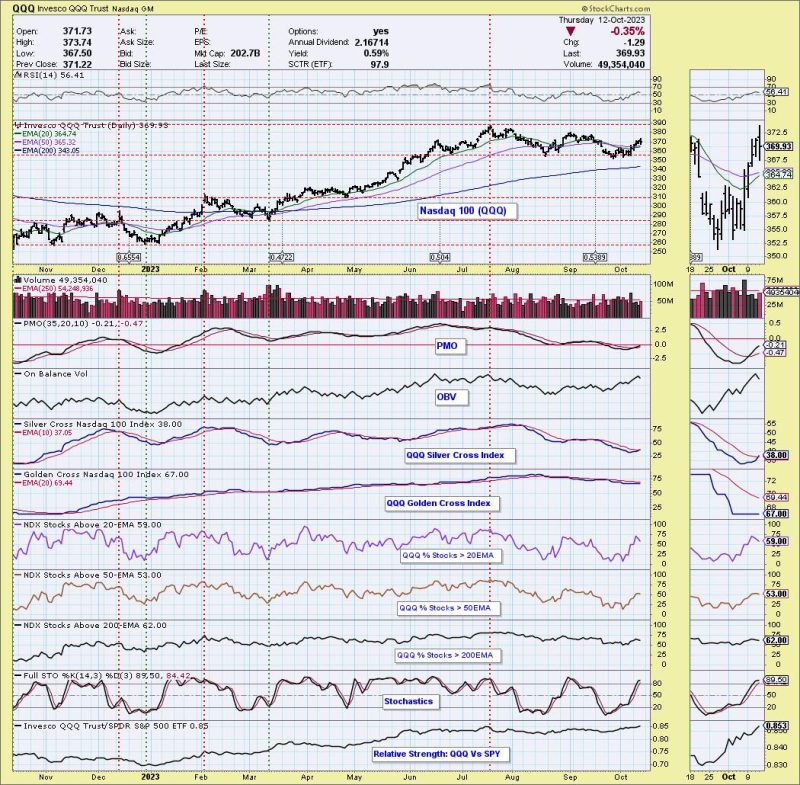

The Nasdaq 100 (QQQ) is an index of 100 of the largest technology and non-technology companies that are listed on the Nasdaq stock exchange. It is designed to track the performance of various publicly traded companies, which makes it a go-to investment for many. Recently, the index has had a bullish bias, meaning investors are expecting prices to increase in the near future.

The Communication Services sector (XLC) is another area of the market that has seen a recent uptick in investor confidence. This sector includes companies involved in communications, media, information and entertainment services, software, and technology services. XLC has been steadily increasing throughout the year in 2020, and the optimism continues into 2021.

Finally, the Transportation sector (IYT) has also recently shown a bullish bias, particularly in the last few months. This sector includes airlines, railroads, trucking, package delivery, and other transportation services. IYT has benefited from the recent rise in oil prices, which has boosted the sector with an influx of capital.

Overall, the markets are looking positive, and investor activity in the Nasdaq 100 (QQQ), Communication Services (XLC), and Transportation (IYT) sectors is likely to continue this trend. So, if you’re looking for a way to diversify your portfolio, these three indices may be worth investigating further. With rising prices and a bullish bias, they could be a great place to start.