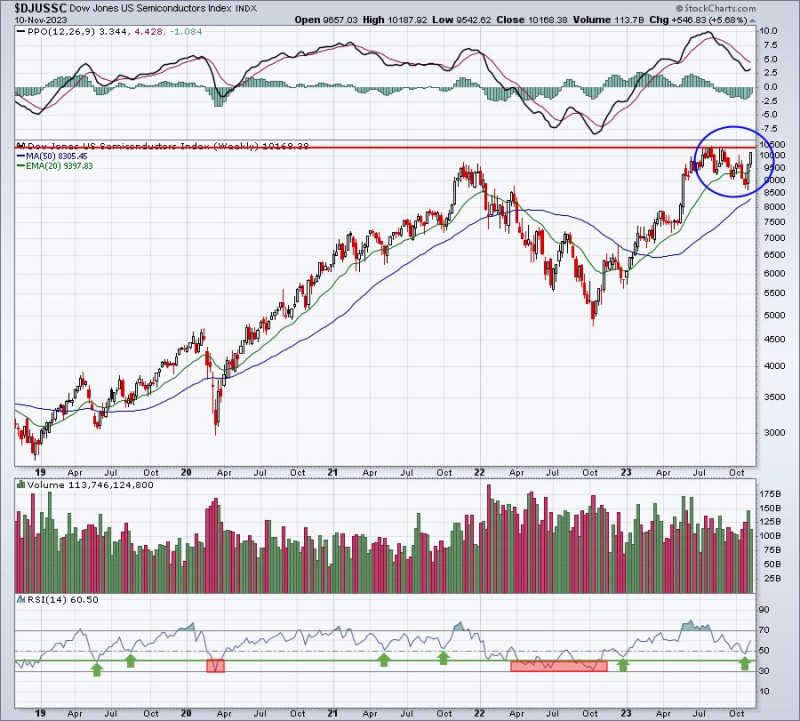

The semiconductor industry is seeing a big surge in demand, and the Nasdaq is responding accordingly, reaching a key high. The trade-off between current earnings and future potential gains has been impressive, making it a great time to be a consumer of these innovative products.

The recent surge in the semiconductor industry is due in part to the fact that a number of key markets are less volatile than usual. Tech giants such as Apple and Amazon are driving up the demand for semiconductors, as their products and services continue to become more complex. As a result, companies involved with semiconductor production have seen substantial revenue growth in recent months.

This increase in demand has led to a corresponding rise in the Nasdaq Composite Index. Reaching a new record high in late February 2021, the index has rebounded from its steep sell-off in November 2020. Stocks, especially those related to the semiconductor industry, offer an unprecedented level of value to investors who are willing to take on risk.

The surge in the semiconductor industry is not without its risks. Investors must be aware that there are still considerable gaps between current earnings and what is expected in the future. This is why trading in semiconductor-related stocks requires careful consideration on every move made.

One key area where the market appears to reward investors is in the realm of “trade-off.” By drawing attention to the potential gains that can be had from taking on additional risk, traders are becoming increasingly confident in the semiconductor industry. This confidence is reflected in the record highs set by the Nasdaq.

Overall, the semiconductor industry seems to be a very solid investment option at this time. For investors who are willing to assess the trade-off between current earnings and future gains, there is a good chance of realizing significant returns over the coming months. With the Nasdaq reaching a key high, the momentum behind the semiconductor sector will only increase, making now the time to invest.