Good economic forecasts and predictions are essential for investors to use the market effectively and maximize their returns. Unfortunately, bad forecasts can adversely affect investor decisions, leading to large losses. It is also important to consider any other factors that may have an influence on investors’ portfolios.

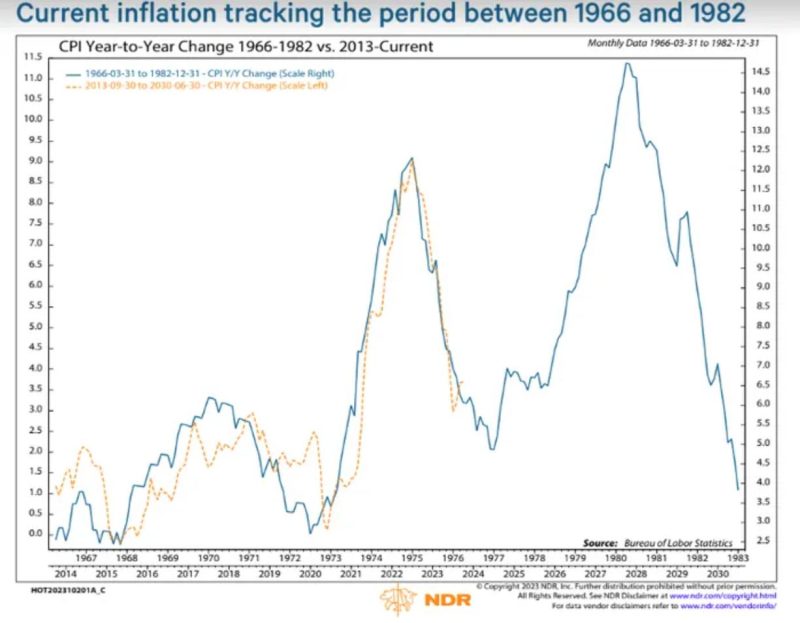

Recently, the equity and inflation outlooks have been underwatch due to turbulence in the stock, bond, and commodity markets. While some indicators suggest that inflation is imminent, there is still uncertainty about the direction of the market. In light of this, it is important for investors to stay cautious and keep an eye on potential changes to their portfolios.

An effective way to stay informed of the equity and inflation outlooks is by watching videos about the topics. These videos can provide investors with a valuable insight into different markets and can help form an effective decision-making strategy. A good video will discuss the most pertinent topics, such as global equity markets, the Federal Reserve’s path, commodities markets, and any other macroeconomic events.

However, investors must keep in mind that the videos are not meant to replace expert advice and should only be seen as supplemental sources of information. While there is a lot of valuable information in these videos, investors should independently research the topics and form their own opinions.

Furthermore, investors should keep a diverse portfolio and diversify their investments across multiple asset classes. That way, portfolio losses can be limited, should one asset class perform poorly. Additionally, investors can consider using investment products like derivatives or ETFs to limit volatility and limit written exposure.

At the end of the day, staying in tune of the equity and inflation outlooks is essential for effective market decisions. By watching investment-related videos and consulting a financial advisor, investors can be prepared for any markets changes and maximize their returns.