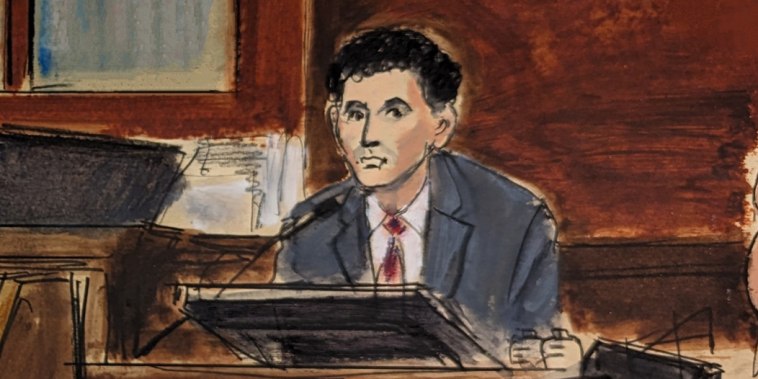

Sam Bankman-Fried, the CEO of FTX, was recently confronted with his own words in a criminal fraud trial. After two days of testimony, Bankman-Fried has still not been proven guilty of any wrongdoing. However, this case shines a light on the often-unseen criminal activities conducted within the crypto sphere.

Bankman-Fried, 30, was called to testify at the Federal District Court in San Francisco at the end of May 2021. He had been accused of committing securities fraud in January of that year when FTX, the cryptocurrency exchange he founded in 2018, was launching its first product.

Prosecutors have pointed to certain emails sent by Bankman-Fried as evidence of his guilt. These emails were sent to potential customers about the product offering, saying that he “moved the launch forward a few hours” to ensure they got the advantage. They argue that regardless of frequency or duration, this early access could be considered a form of unfair advantage, implying insider information and thus criminal behavior.

Bankman-Fried, however, dismissed the emails as a “marketing strategy” and an effort to “build more customer loyalty.” He also argued that the decision to move forward the product launch was purely a business-related one and there was no intention to mislead or defraud anyone.

In addition to questioning Bankman-Fried, prosecutors also called on witnesses with knowledge of the FTX platform. They attempted to prove that the scheme was premeditated and that the emails were part of a plan to defraud customers. However, the witnesses’ testimonies do not provide much evidence to support the claim and there is still no clear answer as to whether Bankman-Fried is guilty or innocent.

What this trial does demonstrate is the complexity of the laws surrounding cryptocurrencies. While many view the digital currency sphere as being largely unregulated, this case shows that criminal behaviors with crypto will be taken seriously. As the crypto space continues to expand and evolve, it’s important to ensure that the investors, as well as the industry’s innovators, are legally protected and that criminal practices are rooted out.

As the case proceeds, it remains to be seen what the judge’s decision will be surrounding Bankman-Fried’s alleged fraud. For now, we can only speculate and watch as the case unfolds.